lenders that do harp loans today: what to know and where to start

Do HARP lenders still exist?

The original Home Affordable Refinance Program ended years ago, but many experienced lenders who handled HARP still help homeowners pursue similar high-LTV refinance options when investor rules allow. Instead of asking for 'HARP,' tell a loan officer you need a relief-style refinance and ask what programs fit your scenario.

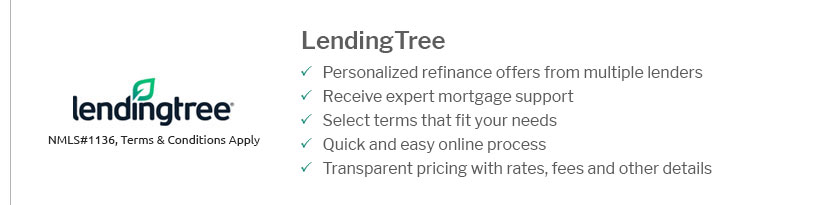

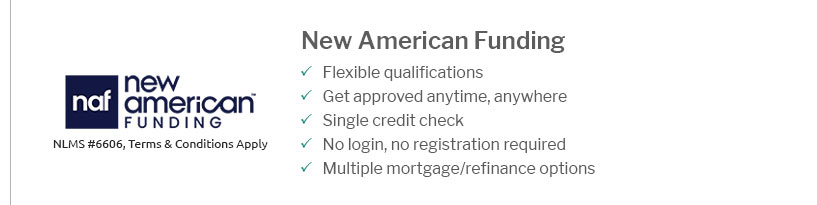

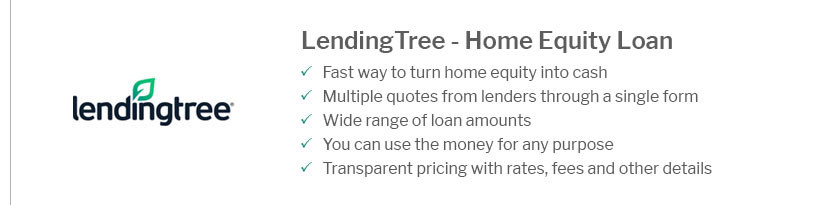

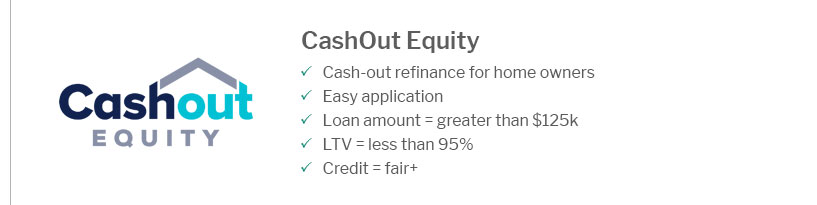

Popular options to compare

Different lender types approach these files differently. Comparing at least three on the same day keeps quotes fair and terms consistent.

- National banks: Broad servicing footprints and recognizable brands, but pricing and overlays can be tighter.

- Credit unions: Member-focused, often with lower fees; membership and geographic limits may apply.

- Independent lenders/brokers: More product variety and nimble underwriting, though service levels vary.

Pro tips: Ask whether your loan is owned by Fannie Mae or Freddie Mac, confirm any loan-to-value and payment history requirements, and request a written cost breakdown. Bring recent statements, income docs, and insurance info so the file moves quickly. If your current servicer offers a streamlined path, compare it against an outside quote before deciding.